Blog

Burberry, Adidas and Levi’s bet big on Oasis reunion tour

By

Bloomberg

Published

July 4, 2025

The iconic British band Oasis kicks off its long-anticipated reunion tour on Friday with a show in Cardiff, reigniting a wave of ’90s Britpop nostalgia—and fashion brands are ready to roll with it.

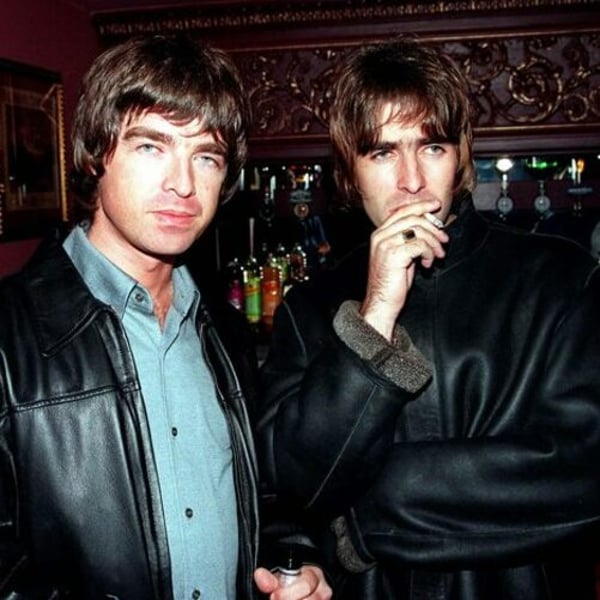

Despite the famously rocky relationship between Liam and Noel Gallagher, the tour promises a cultural moment too big for the fashion industry to ignore. From North America to Asia, retailers are tapping into the emotional pull of the past, hoping to turn a musical comeback into a sales boom.

Recent music events—most notably Beyoncé’s Cowboy Carter and Charli XCX’s Brat—have proven how album launches and tours can drive fashion trends. Levi Strauss & Co. famously joined forces with Beyoncé after her “Levii’s Jeans” lyric, temporarily renaming its Instagram account and launching a campaign with the singer. Coach’s Kate Spade line embraced Brat, while stars like Taylor Swift were dressed by brands including Versace, Cavalli, and Tiffany & Co.

Now, brands are calling this moment the “Wonderwall Summer.”

Leading the charge is Burberry Group Plc. Though not officially tied to the tour, Burberry’s latest campaign celebrates the Gallagher legacy. It stars Liam Gallagher along with his sons Lennon and Gene, and daughter Molly Moorish-Gallagher. The visuals—featuring music icons like Goldie, and models Cara Delevingne and Alexa Chung—recall Burberry’s golden era in the ’90s. Liam is seen wearing the parka he first debuted in 2018, which is now being reissued in limited quantities.

Meanwhile, Adidas AG is taking a more direct approach, launching a co-branded Oasis collection available online, in-store, on Oasisinet.com, and at concert venues throughout the tour. Levi’s created a limited series of graphic T-shirts, while Moncler’s Stone Island featured Liam Gallagher in its autumn campaign.

Unlike recent music-tour collaborations driven by female artists, Oasis draws a mixed-gender fan base, offering opportunities for both menswear and womenswear. With the men’s clothing and footwear market valued at roughly two-thirds of womenswear, brands see untapped potential.

While the Oasis revival has attracted a younger crowd through ongoing ’90s nostalgia, nearly half of the ticket holders have seen the band live before, according to Barclays Plc’s Consumer Spend report. The group hasn’t performed together since 2009, meaning the audience skews older—and often more affluent.

Many of Oasis’ signature styles—baggy jeans, football jerseys, and low-rise sneakers—have returned through the “Blokecore” trend. Fashion choices among fans reflect the times: Swifties wore sequins, the Beyhive chose cowboy hats, and Oasis fans are opting for parkas and bucket hats.

Even in summer heat, demand for parkas is rising. TikTok posts referencing parkas jumped 188% between June 1 and July 1, with video views up 121%, according to Trendalytics. Searches for parkas on resale platform Depop surged by 1,850% year over year in June. Bucket hats are also seeing renewed interest.

About one-third of British fans plan to dress in ’90s styles at the concerts, and more than 20% expect to wear co-branded items, according to Barclays.

Barclays estimates that Oasis fans in the UK alone will spend £1.06 billion ($1.4 billion) on the tour—including tickets, travel, and merchandise. That total edges out the £997 million spent by Taylor Swift fans during the Eras Tour, partly due to Oasis scheduling 17 shows compared to Swift’s 15.

After completing the UK leg, Oasis will head to North America in August and September, before performing in Asia and South America. For both the band and its partner brands, cracking the US market remains a major goal.

Burberry may stand to gain the most. With uncertainty in the Chinese luxury sector, a recovering US market—buoyed by easing tariffs—is looking more attractive. Adidas, still trailing behind Nike in US market share, also hopes to boost visibility stateside.

Oasis’ relationship with fashion has had its ups and downs. Liam Gallagher founded his label Pretty Green in 2009, but it went into administration and was acquired by JD Sports in 2019. The brand was later sold to Frasers Group, which no longer owns it.

The biggest risk? A band breakup mid-tour. Oasis famously split before a Paris show in 2009. Still, the current media frenzy and brand engagement have already paid off. Even if the tour falters, tension between the brothers is likely to generate more attention than silence.

Whether or not this becomes a true “Wonderwall Summer,” fashion brands betting on Oasis aren’t likely to look back in anger.